This coverage kicks in when the other driver has no insurance. If the at-fault driver has no insurance, UM will cover your expenses, including medical costs and property damage.

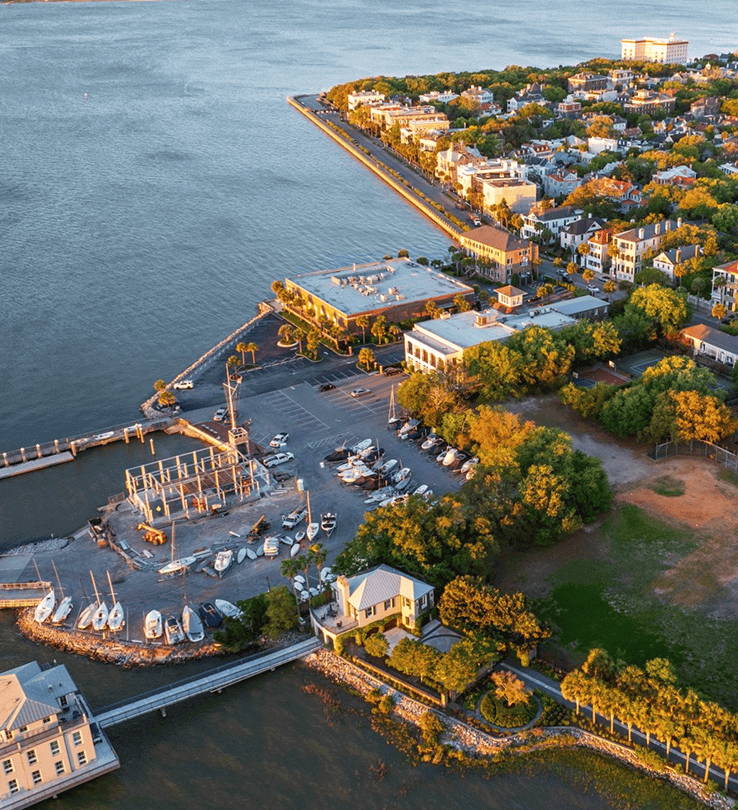

Car accidents can be stressful enough. You have to deal with your injuries, figure out how to get your car repaired or replaced, and manage your medical bills. But what happens if the at-fault driver doesn’t have enough insurance to cover your expenses? Even worse, what if the at-fault driver has no insurance at all? Our skilled Charleston Underinsured/Uninsured Motorists Lawyers can help you get the compensation you deserve if an uninsured or underinsured motorist hits you.

Dealing with insurance after a car accident can be complex, and navigating it alone can be overwhelming. You will want an experienced Underinsured/Uninsured Motorist law firm to guide you through the process. Let us help you get the compensation you deserve and make the road to recovery smoother.

Car Insurance in Charleston, South Carolina

South Carolina law requires drivers to have automobile liability and uninsured motorist coverage. There are several components to car insurance in the state. The first two types apply if you are the at-fault driver, while the last applies if you are not at fault:

- Liability Insurance for Bodily Injury: Drivers must have at least $25,000 for each person and $50,000 for each accident. This insurance covers medical bills, lost wages, and other losses for the injured party if you are negligent.

- Liability Insurance for Property Damage: Drivers must have at least $25,000 in property damage coverage, which pays for damage to the other driver’s vehicle if you are at fault.

- Uninsured Motorist Coverage: Drivers are required to have the same amount of uninsured motorist coverage as their liability coverage. This helps cover your costs if the at-fault driver doesn’t have insurance.

Additionally, you can purchase underinsured motorist (UIM) coverage, which is optional in South Carolina. While not required, UIM coverage can make a significant difference if you’re in an accident with a driver who doesn’t have enough insurance to cover your expenses. If the at-fault driver lacks sufficient coverage, your underinsured motorist coverage kicks in. Without this insurance, you may have to pay out-of-pocket for the remaining costs. That’s why we always recommend our clients add underinsured motorist coverage to their auto policy.