Getting into a car accident is one of the most stressful experiences you can face. In those first moments after a collision, your mind races, your adrenaline spikes, and it can be hard to think clearly. But what you do in the minutes, hours, and days after a car accident in South Carolina can make or break your ability to recover fair compensation for your injuries.

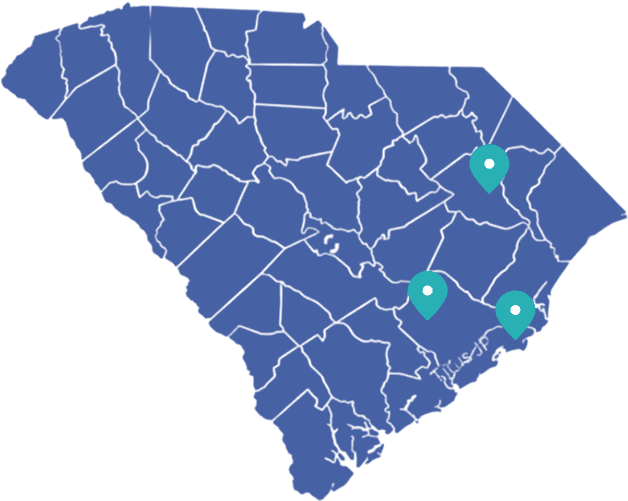

At Crantford Meehan, we have helped hundreds of accident victims across Charleston, Florence, and Summerville protect their rights after a crash. Here is exactly what you need to do if you are ever in a car accident in South Carolina.

Step 1: Stay at the Scene and Check for Injuries

South Carolina law requires you to stop at the scene of any accident involving injury, death, or property damage. Leaving the scene can result in criminal charges, including a felony hit-and-run if someone was seriously hurt.

Once you have stopped safely, check yourself and your passengers for injuries. If anyone is hurt, call 911 immediately. Even if injuries seem minor, err on the side of caution. Many serious injuries, including traumatic brain injuries and internal bleeding, do not show obvious symptoms right away.

Step 2: Call the Police

Always call law enforcement, even for minor fender-benders. A police report creates an official record of the accident that can be critical evidence later. When the officer arrives, provide an honest account of what happened, but stick to the facts. Do not speculate about fault or apologize for the accident, as these statements can be used against you later.

Under South Carolina law, you must report any accident that results in injury, death, or property damage exceeding $1,000. If police do not investigate the scene, you are required to file a self-report (Form FR-309) within 15 days of the collision.

Step 3: Document Everything at the Scene

If you are physically able, start gathering evidence immediately. The more documentation you have, the stronger your case will be. Take photos and video of the damage to all vehicles involved, the overall accident scene from multiple angles, skid marks, debris, and road conditions, traffic signals, signs, and road markings, any visible injuries you or your passengers have, and the other driver’s license plate and vehicle.

Exchange information with the other driver, including their full name, phone number, and address, their insurance company and policy number, their driver’s license number, and the make, model, and color of their vehicle.

If there are witnesses, get their names and contact information as well. Witness testimony can be invaluable if the insurance company disputes what happened.

Step 4: Seek Medical Attention Right Away

This is one of the most important steps, and it is the one people most often skip. Even if you feel fine after the accident, see a doctor within 24 to 48 hours. Here is why this matters so much.

First, some injuries take days or even weeks to show symptoms. Whiplash, herniated discs, concussions, and soft tissue injuries frequently have delayed onset. Second, medical records create a direct link between the accident and your injuries. If you wait weeks to see a doctor, the insurance company will argue that your injuries were caused by something else. Third, gaps in medical treatment give insurance adjusters ammunition to minimize or deny your claim.

Go to the emergency room, urgent care, or your primary care doctor. Describe every symptom, no matter how minor it seems. Follow through with all recommended treatment and follow-up appointments.

Step 5: Notify Your Insurance Company

Contact your insurance company to report the accident, but be careful about what you say. Provide basic facts: the date, time, location, and that an accident occurred. Do not give a recorded statement or accept any settlement offers without first speaking to an attorney.

South Carolina is an at-fault state, meaning the driver who caused the accident is responsible for paying damages. However, your own insurance company may try to limit what they pay, and the other driver’s insurer will almost certainly try to minimize your claim.

Step 6: Do Not Talk to the Other Driver’s Insurance Company

This is critical. The other driver’s insurance adjuster may contact you shortly after the accident, sounding friendly and concerned. Do not be fooled. Their job is to protect their company’s bottom line, not to help you. They may ask for a recorded statement, push you to accept a quick settlement, or try to get you to say something that undermines your claim.

You are under no obligation to speak with the other driver’s insurance company. Politely decline and refer them to your attorney.

Step 7: Keep Detailed Records

Start a file for everything related to your accident. This should include the police report, all medical records and bills, receipts for prescriptions and medical devices, documentation of lost wages from your employer, records of any out-of-pocket expenses related to the accident, a journal documenting your pain levels, limitations, and emotional impact, and all correspondence with insurance companies.

These records will be the foundation of your claim. The more organized and thorough you are, the better positioned you will be to recover full compensation.

Step 8: Consult a Personal Injury Attorney

Insurance companies have teams of adjusters and lawyers working to pay you as little as possible. You deserve someone fighting just as hard on your side.

A personal injury attorney can investigate your accident and preserve critical evidence, calculate the true value of your claim including future medical costs and lost earning capacity, handle all communication with insurance companies, negotiate aggressively for a fair settlement, and take your case to trial if the insurance company refuses to offer fair compensation.

At Crantford Meehan, your initial consultation is free and you pay nothing unless we win your case. We work on a contingency fee basis because we believe everyone deserves access to quality legal representation, regardless of their financial situation.

Key South Carolina Laws You Need to Know

Understanding your state’s laws can make a significant difference in your case.

Three-Year Statute of Limitations. You have three years from the date of the accident to file a personal injury lawsuit in South Carolina. For claims against a government entity, the deadline is shortened to two years. Missing this deadline means losing your right to compensation forever, so do not wait.

Modified Comparative Negligence. South Carolina follows a modified comparative negligence rule. This means you can still recover compensation even if you were partially at fault for the accident, as long as your share of fault does not exceed 50 percent. However, your award will be reduced by your percentage of fault. For example, if you were 20 percent at fault and your damages total $100,000, you would receive $80,000.

Minimum Insurance Requirements. South Carolina requires drivers to carry at least $25,000 per person and $50,000 per accident in bodily injury liability coverage, $25,000 in property damage liability coverage, and uninsured motorist coverage equal to their liability limits. Unfortunately, minimum coverage is often insufficient to cover serious injuries, which is why having an experienced attorney evaluate all potential sources of recovery is so important.

New Hands-Free Law. As of late 2025, South Carolina now prohibits drivers from holding a phone while driving for texting, emailing, social media, or video calls. If the other driver was using their phone at the time of your accident, this could be strong evidence of negligence.

Common Mistakes That Can Hurt Your Case

Over the years, we have seen good people make avoidable mistakes that cost them thousands of dollars. Here are the biggest ones to watch out for. Do not post about the accident on social media, as insurance companies monitor your accounts. Do not give a recorded statement to any insurance company without an attorney present. Do not accept the first settlement offer, as it is almost always far less than your case is worth. Do not sign any documents from the insurance company without having an attorney review them. Do not wait too long to get medical treatment or to consult an attorney.

We Are Here to Help

If you or a loved one has been injured in a car accident in South Carolina, the attorneys at Crantford Meehan are ready to fight for you. With offices in Charleston, Florence, and Summerville, we serve accident victims across the state.

Call us today at (843) 832-1120 for a free, no-obligation consultation. We are available 24/7 because accidents do not wait for business hours.

This article is for informational purposes only and does not constitute legal advice. Every case is unique, and outcomes depend on the specific facts and circumstances involved. Contact Crantford Meehan to discuss your specific situation.